Here you can find SFMI management information including board of directors, shareholder composition, and credit ratings.

Board of Directors(BOD)

SFMI’s BOD provides full support for the management to ensure responsible management based on a sound management philosophy. When issues arise regarding guidelines, procedures, and methods of the business activities of management, the company’s BOD points out relevant issues and call for redress to ensure that reasonable business decisions are made. To that end, SFMI’s BOD is comprised of experts from different fields and every possible effort is made to ensure active communication among the members; it also makes use of independent experts, if necessary.

Directors

- CEOMun Hwa Lee

- Executive Vice PresidentSeong Woo Hong

- Executive Vice PresidentYoung Min Koo

Outside Directors

- Jin Hei Park

- Yung hoon Sung

- Seong Yeon Park

- So Young Kim

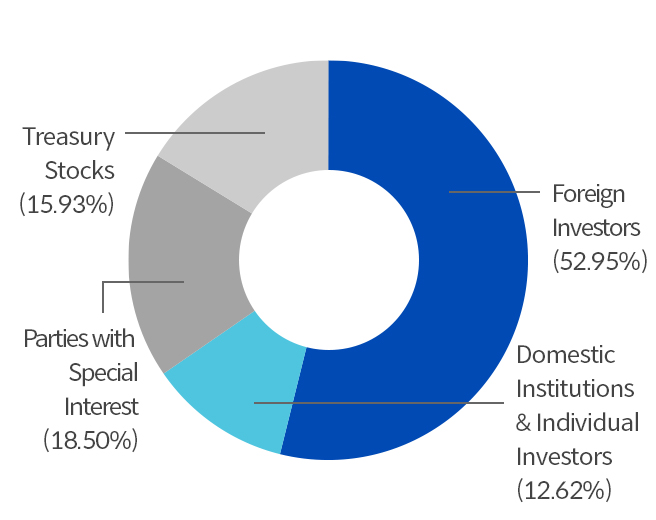

Shareholder Composition (Common Stock as of Dec 31, 2024)

- Common Stock Distribution Chart (Issued by Korea Securities Depository)

Credit Rating

SFMI has been recognized by global rating agencies for its strong capital adequacy, stable business performance, and outstanding risk management.

A.M.Best

SFMI has been granted the highest rating of A++ by A.M. Best, the largest insurer credit rating agency in the world, in recognition of strong capital structure, stable business

performance, and sound risk management practice.

A.M.Best

SFMI has been granted the highest rating of A++ by A.M. Best, the largest insurer credit rating agency in the world, in recognition of strong capital structure, stable business

performance, and sound risk management practice.

- A++ (Superior)

-

-

A++

- 2022

- 2023

- 2024

- A+

- A

- A-

-

A++

S&P

SFMI maintained S&P credit rating of AA- with a Stable outlook in 2024 in recognition of its financial strength, market-leading status, solid business performance, and excellent risk

management.

S&P

SFMI maintained S&P credit rating of AA- with a Stable outlook in 2024 in recognition of its financial strength, market-leading status, solid business performance, and excellent risk

management.

- AA- (Stable)

-

- AA

-

AA-

- 2022

- 2023

- 2024

- A+

- A